ILLUSTRATION: Crop of Robots Attack the Morgan Stanley Building (2005) • watercolor & ink • 22×30″

Click here for Part I: Sneakers, Fire Fighters, and McKinsey.

Previously I decided to investigate whether the acquisition strategy of tech companies warrants a different look at standard equity valuation methodology. For this analysis, I’ve ignored eCommerce (which has its own particular challenges with standard retail comps) and focused on digital media: Google, Facebook, Yahoo!, and LinkedIn.

First, a disclosure: I own shares of/am long Google, and I own puts on/am short Facebook. This analysis doesn’t constitute investment advice, nor am I recommending or proposing any set of projections for these companies. This is but one analysis whose purpose is to show what a change in valuation methodology would do to your own company projections. Plus I might be wrong.

Second, a summary:

- The dilution impact of regular share issuance, whether it be from an acquisition or from employee compensation, seems terribly underestimated in traditional valuation approaches.

- Traditional discounted cash flows (DCFs) based on treasury share method share counts ignore projected new share issuance.

- Investors ignore GAAP non-cash stock based compensation (which is, all things considered, still f***ing useless) and instead look to treasury share method diluted shares outstanding for EPS; the former fails to capture issuance timing while the latter ignores the compound effect of future issuance.

- Analyst EPS estimates usually factor in additional share issuance, but these estimates naturally ignore the cash outlay of buybacks that help maintain shares outstanding.

- As an example, using Facebook’s current share issuance trends, a traditional DCF would overvalue shares by 35-47% compared to the change in methodology I detail here. Eek. The data on Facebook is probably too thin at this point, but it remains an outlier especially when it comes to the use of stock compensation and stock issuance relative to its peers. That’s kind of what happens when you spend $17 billion on a freemium/$1 subscription business.

Company valuation is an inexact science, if you can even call it that. Knowledgeable and reasonable investors will absolutely disagree on the valuation of even the most mature of companies with the same set of financial projections. I’m pretty sure disagreement on financial matters is the second tenet of Buddhism after “existence is suffering.” For younger companies with higher growth profiles, like those of VCs, valuation and investing is akin to art, almost divorced from financial theory—a combination of golden gut/crystal ball dynamics, non-financial metric alchemy, anchoring bias, and general availability of dry powder, among other things. For both VC and private equity, the art/science of valuation is completely different from public markets and based on return rates.

However, basic finance theory (and common sense) tells us that the theoretical value of a public company is based on an assumption of its future cash flows. By discounting these cash flows back to the present, also known as a DCF, you generate that theoretical value. Since in reality, a public market investor isn’t going to get but a fraction of those cash flows (if ever) and since estimating a company’s next quarter is super difficult, let alone next year or ten years down the line, investors often use near-term earnings-per-share (EPS) estimates and multiples as a shorthand for valuation (or just pull it out of their ass). #TeamHumanities—just trust me on this, and perhaps enjoy the fact that “everything in this world, including money, operates not on reality—but the perception of reality.” (I knew I could connect this back to Sneakers.)

All valuation methods are imperfect and can/will be gamed. Most of the “one-time” adjustment games that go on in adjusting a standard accounting EPS to an investor-friendly one are well-known and accepted due to accounting rules that can distort what’s going on operationally (to a degree). Whereas DCFs are often treated like black boxes and, as such, obfuscate valuation especially for high-growth companies with large terminal values when capital is cheap. With any skill, a finance-type can make a DCF stand up and whistle Dixie if he or she wanted.

Timeo argentarios et DCFs ferentes[1]

Download the Excel spreadsheet referenced herein.

When I started this analysis, I had wanted to see if the use of acquisitions to replace R&D was a distortion being ignored in typical valuation methodology. Here were the assumptions I wanted to test:

- Are digital media companies acquiring others for technology that ostensibly would have be developed in-house?

- Are digital media companies spending less on R&D and more on acquisitions?

- What would be the valuation impact of projected acquisition expense on EPS or a DCF?

To begin I looked at Google’s and Facebook’s acquisitions that have known deal values, and I tried to sort them into either businesses that could have reasonably been developed by an internal R&D team or businesses that would have been a stretch, that feel more like adjacencies or new business lines. For Facebook, an example of the former would be WhatsApp or Instagram, and the latter would be Oculus VR. For Google, an example of the former would be AdMob, and the latter would be Nest. This wasn’t a particularly good analysis, and all it did was confirm my confirmation bias that Google tended to spend money on new business lines and Facebook tended to spend money on existing ones. Bah. You could make a case that Facebook was spending a kind of maintenance capex, but what of it?

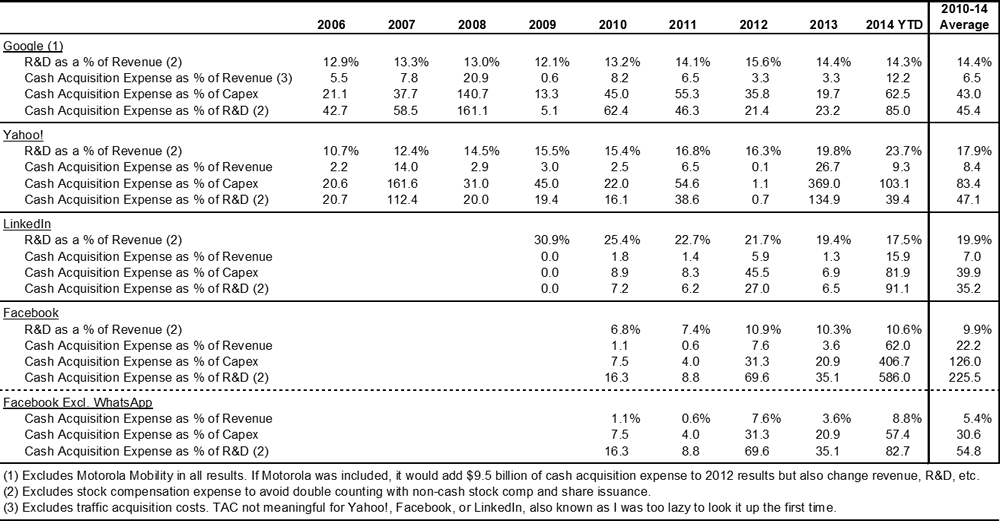

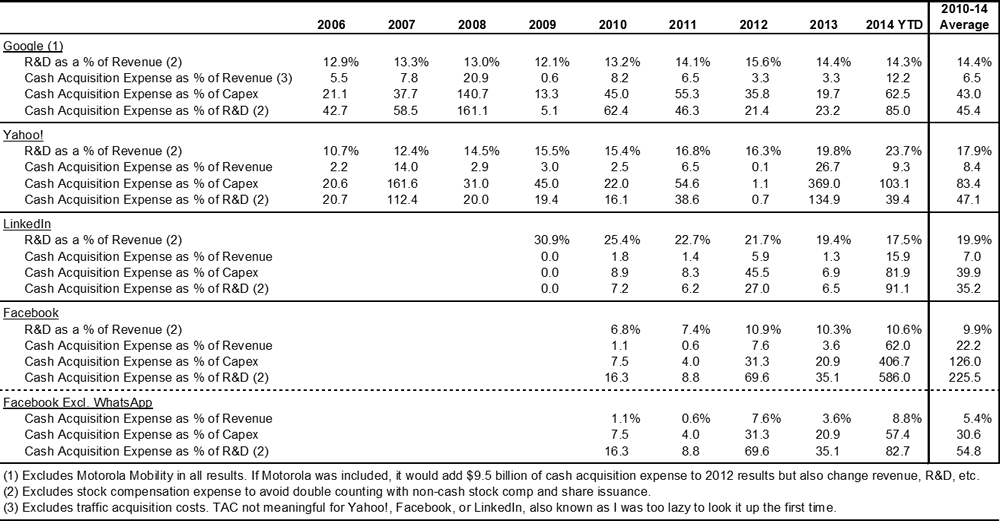

So I pulled an analysis together to see whether acquisition expenditures even mattered financially, which is probably where I should have started. How does cash acquisition expense impact free cash flow margin, for example? Or how does cash acquisition relate to R&D expense?

Excluding that crazy Facebook/WhatsApp deal, it seems cash acquisition expenditures historically represent a 5-10% impact on free cash flow margin. It’s a minor distortion, roughly equal to 50% of capex or 50% of R&D spend—something, but nothing ridiculous, especially given the margin of error (not used literally here as in statistics) in most DCFs. And there’s no real way, other than a constant non-cash goodwill impairment, to recognize the cost of an acquisition in EPS, so you have to assume that it’s baked into the P/E multiple assumption as a change in the underlying cash balance/capital structure.

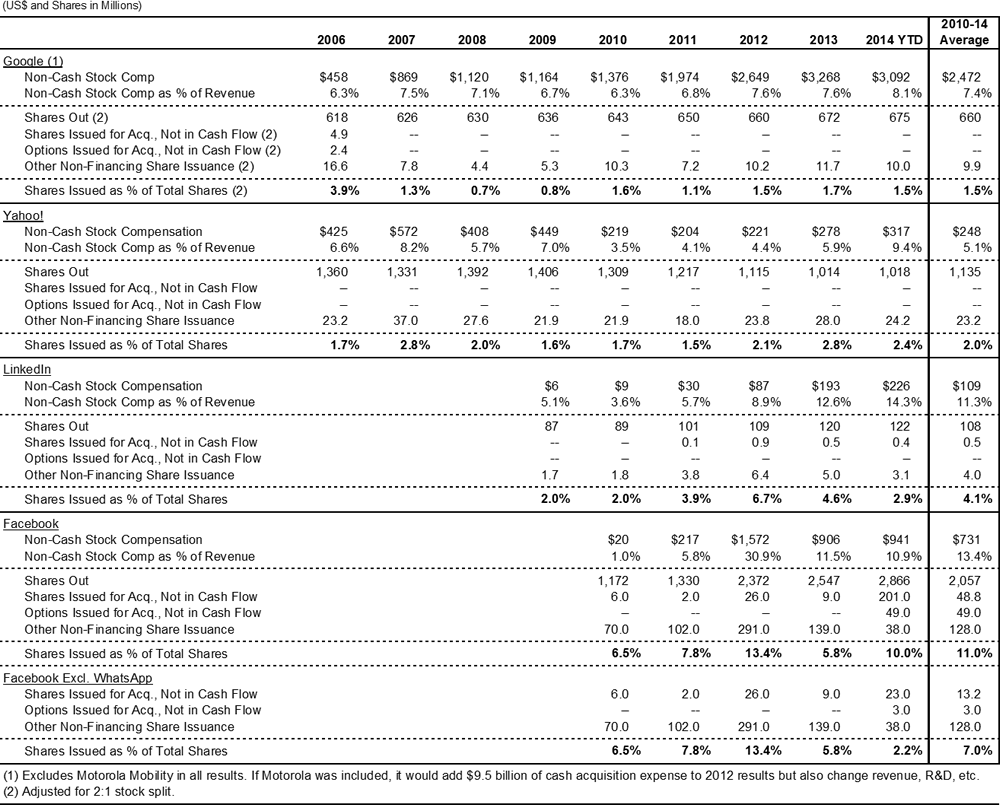

The next step was to understand the impact of stock deals obviously not reflected explicitly as acquisitions on the cash flow statement. Most deals for these companies are cash, and many filings lacked sufficient information on stock or options issued specifically for acquisitions. So I decided to track overall share issuance, and overall share issuance happens to be a lot more interesting.

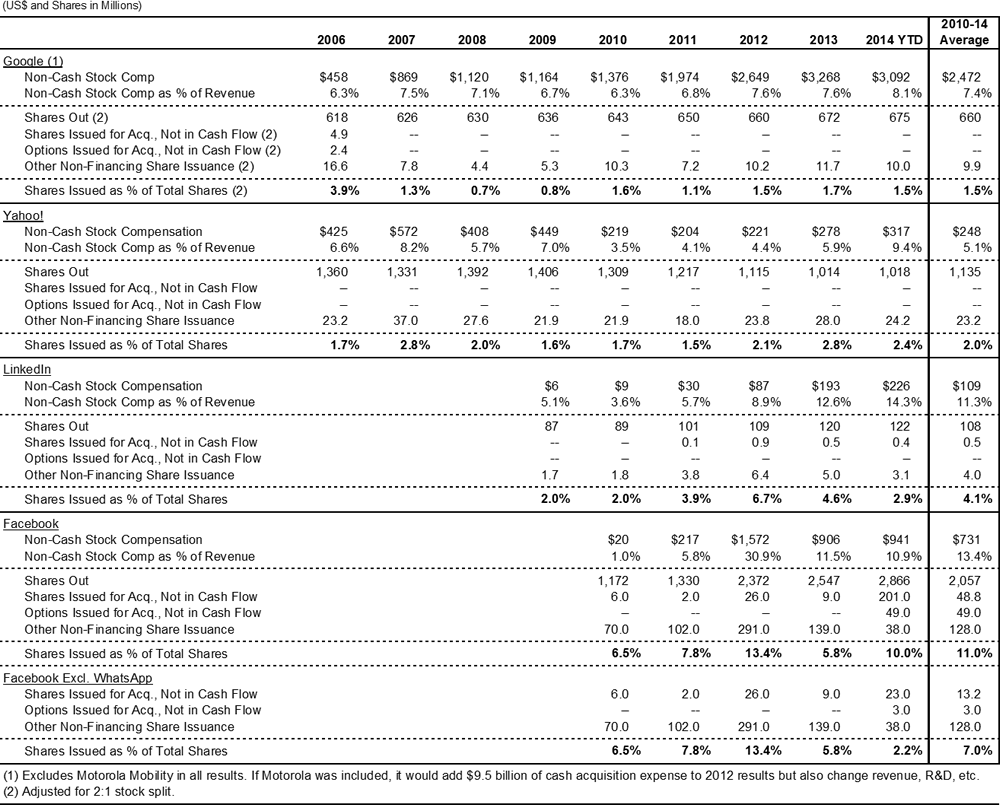

In this chart, I’ve tracked the dilution of all non-financing share issuance against the total shares outstanding. Google clocks in at an average of 1.5%, Yahoo at 2%, LinkedIn at 4%, and Facebook at 7% to 11% depending on whether you include or exclude WhatsApp as a one-time, Black Swan event. I’m going to give Facebook the benefit of the doubt since they’re a young company.

Still you might think, so what? Who cares about 2% dilution? My cost of capital gets cheaper every time the Fed speaks. Here’s the rub: a 5% decrease in margin that flows through to free cash flow every year has a roughly equivalent impact on valuation depending mostly on the terminal value, but a 2% increase in shares outstanding each year has a compounding impact much, much greater.

Shares are forever, at least until they’re bought back. Let’s take a look.

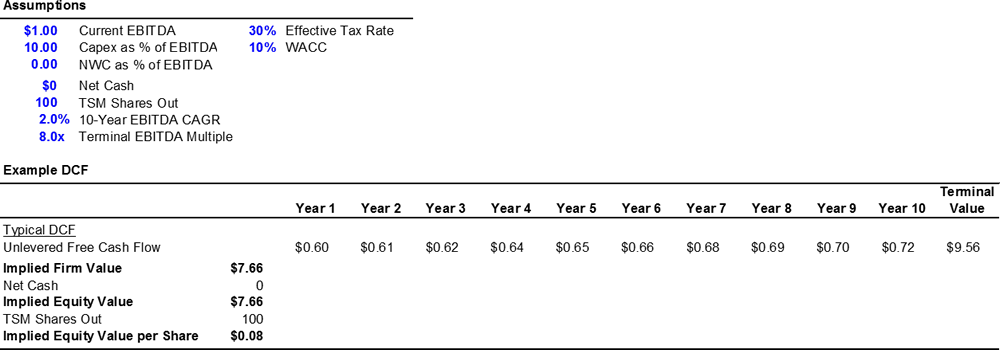

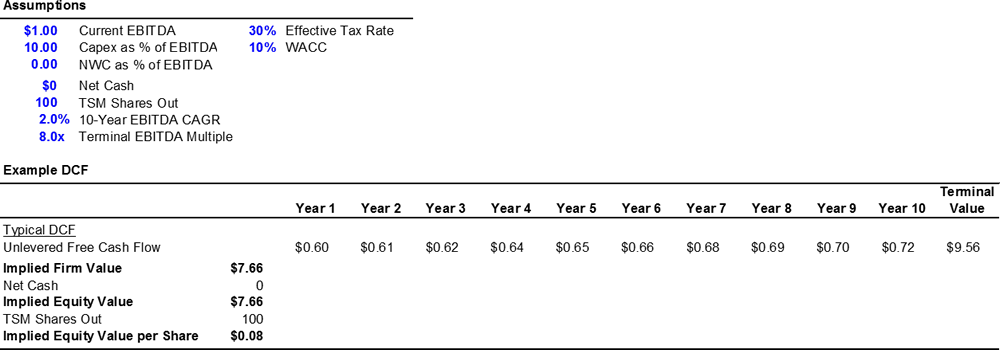

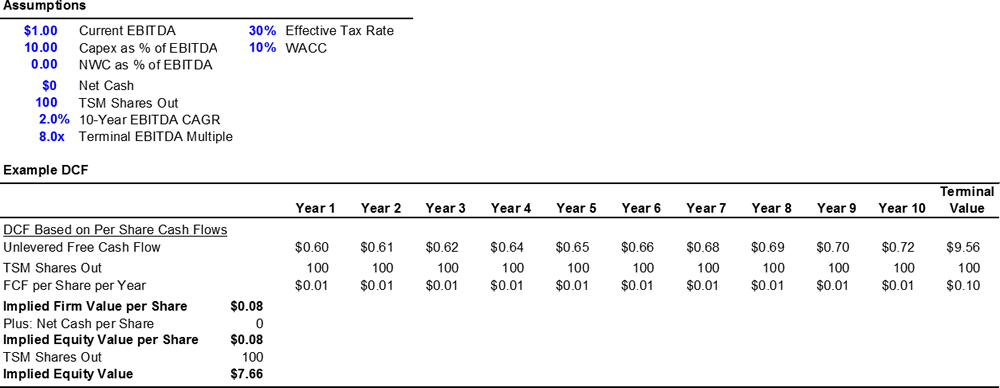

For simplicity, I’ve built a DCF with $1 in current period EBITDA, 10% capex, no working capital adjustments, a 30% effective tax rate on EBITDA, a 8x terminal multiple, and a 10% weighted average cost of capital. I’ve ignored deferred taxes or tax benefits for stock options, and this scenario implies a 2.3% perpetuity growth rate for free cash flow which is perfectly cromulent. I like using $1 for EBITDA in sample DCFs because the valuation and current valuation multiple are equivalent as you are dividing by one. Plus you strip away all the pretense and black box nature of typical models. You can pretend this is any company where 1 = 100% of current EBITDA.

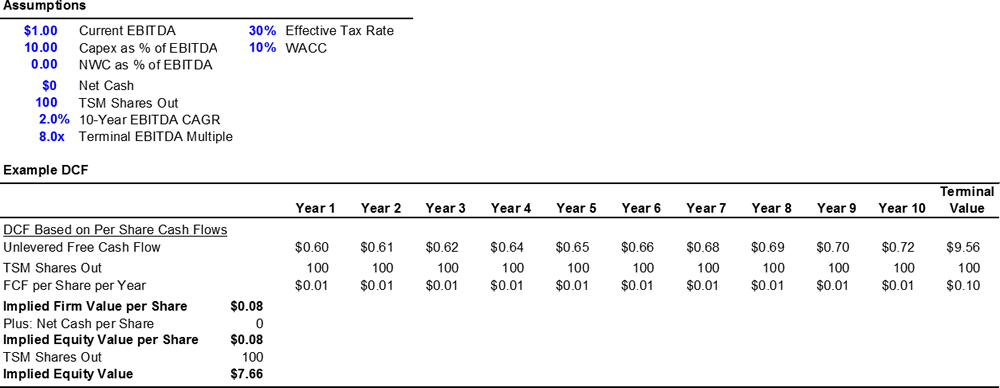

In most DCFs to get to an equity value per share (after net cash adjustments) you circularly divide by the treasury share method diluted share count with the implied equity value per share as an input for cashless exercise. It’s a perfectly acceptable way to represent the current moment in time. You can also look at the free cash flow per share in the forecast period and resolve to the same valuation.

However, we discussed earlier that diluted share count misses two things that seem to be a matter of course: the shares issued in future acquisitions, and the options/restricted stock granted and exercised year-in, year-out. I’ve built this capability into equity analyst DCFs before, but 1) I’ve only ever turned it on for forecast EPS estimates, and 2) I’ve never thought the dilution rate was so high. We used to forecast 1%, not 7%.

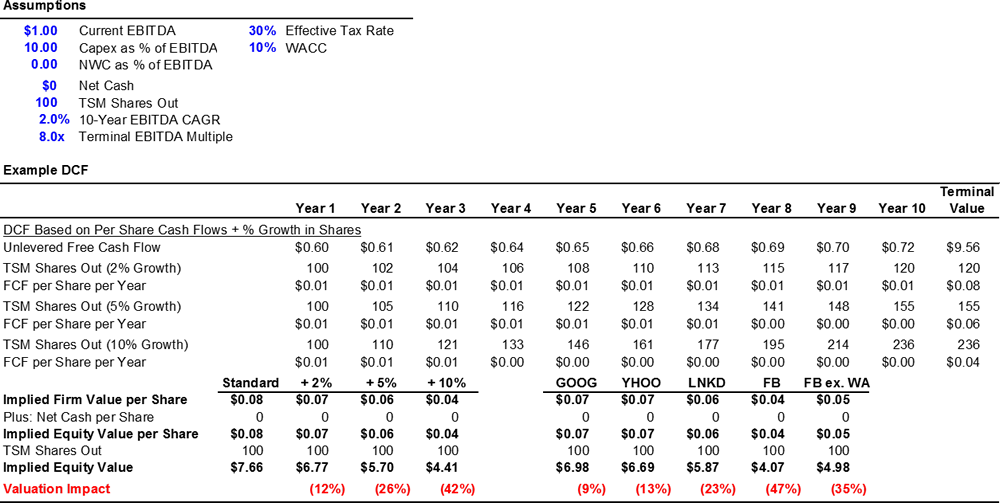

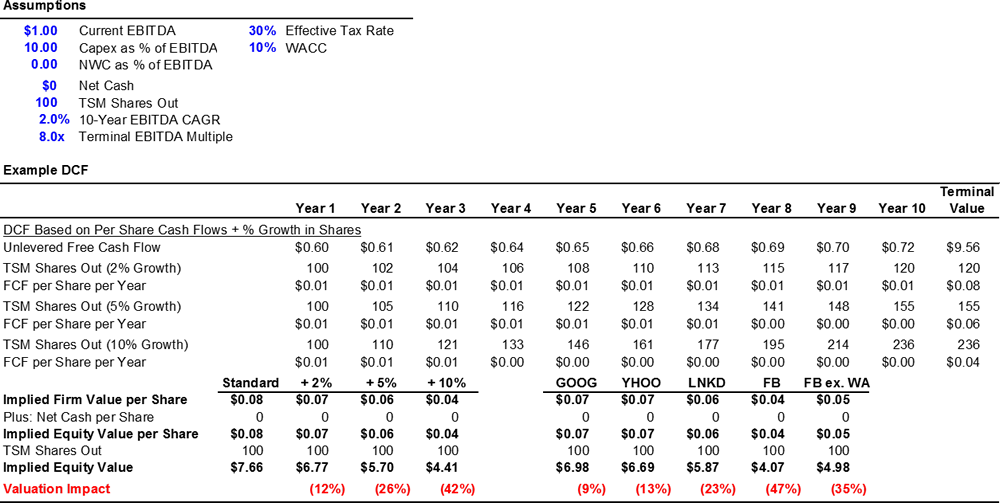

So here’s that same free cash flow per share analysis with 2%, 5%, and 10% growth in shares over the forecast period. You discount the resulting free cash flow per share back to the present, adjust for the capital structure, and then you multiply by the CURRENT treasury share method share count (based on your implied equity value per share) because you’re trying to figure out what a share today is worth. Those share growth assumptions have a compounding impact on valuation of 12%, 26%, and 42% respectively.

Again, shares are forever unless they’re bought back (which happens… a lot).

I’ve also shown what that valuation would look like with the selected companies’ respective average share issuance per year. Facebook takes a 35-47% valuation hit if you assume they continue to issue shares as they have recently. I don’t think they will, but it’s a helpful guidepost.

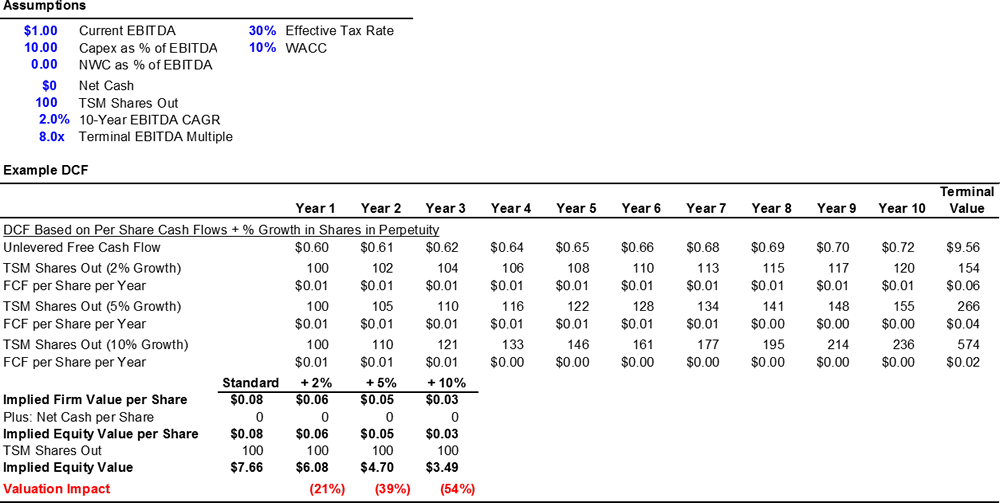

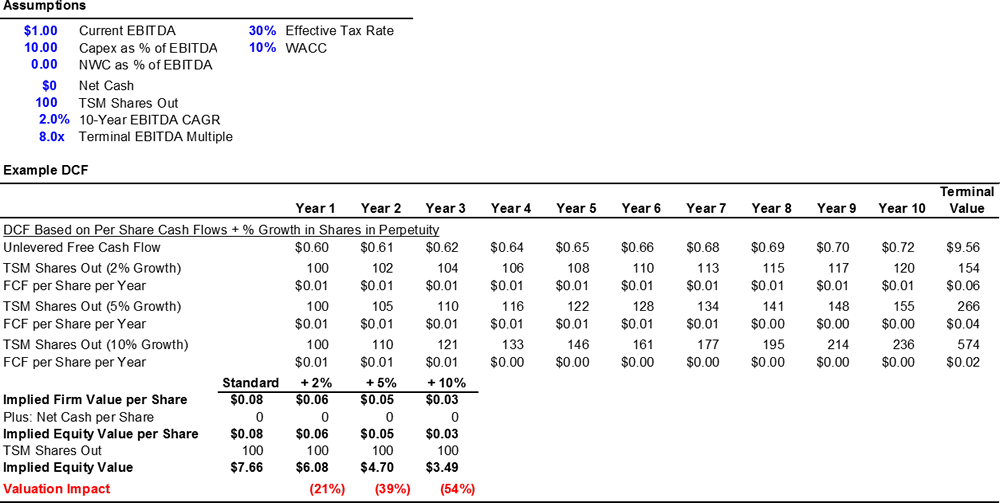

The above analysis is based on keeping shares at a steady state once you reach the terminal year. It’s way scarier if you assume that shares continue to grow. See below.

Ugh.

Stock compensation is a great deal if you work for these companies. You issue more and more shares as a percentage of compensation, and your stock price still goes up because it looks like you’re improving your margins.

And just in case you were wondering, higher terminal multiples, higher CAGRs, and lower WACCs all result in worse dilution. It’s like a perfect bubblicious storm when return rates and WACCs diverge.

Entrepreneurs and venture capitalists fight for every share and option issued. It’s a zero-sum game. Every share issued takes $$$ away from someone else. So what gives in the public markets? Why do so many investors turn a blind eye to the ongoing shift of compensation from cash to stock because it’s a non-cash accounting adjustment at the outset? I guess I was guilty of this mistake as well in the past.

Investors also clearly understand how future maintenance capital expenditures work. We tend to ignore that acquisitions can serve a similar purpose, to maintain a position, to defend against market share loss, to stifle a future competitor. (And yes, some acquisitions are different. YouTube basically evolved into a new business for Google and probably generated $2 billion in revenue after TAC last year based on an analysis I did for Jefferies this year to estimate YouTube’s financial model since acquisition. But I also estimate Google spent $6+ billion in addition to the $1.65 billion acquisition to get to that revenue level.)

If my logic and math hold up, then between future “maintenance” acquisitions and stock compensation, we might be overvaluing some tech companies by 20-50% or more relative to whatever set of projections you’re using.

It makes you want run to the window and scream, “I’m mad as hell, and ‘Pro forma’ doesn’t mean what you think it means! I took Latin! And pivot means the same thing as turnaround, for goodness sake!”

Not that I’ve done that.

If I can bring myself to do a third post on Bubble Valuation, I’d like to investigate maybe why we ignore these distortions. I’ve posited a few reasons…

First are the accounting rules around GAAP non-cash stock based compensation. For example, Non-cash stock based compensation matches with grants instead of issuance, and its calculation inherently ignores the fact that equity is most valuable to an employee when the stock price is lower and set to rise. Moreover, I would like to see if the move to restricted stock has anything to do with how it’s accounted for at grant price vs. a Black-Scholes-Merton method for traditional incentive stock options.

Second are the accounting rules around amortization of goodwill. Could goodwill’s lack of presence on the P&L inure us to ignoring its effect on the balance sheet? Can you impair something that never makes money if it never made money in the first place? I don’t really know (and I’m happy for someone to tell me, so I don’t have to look it up).

Third is a qualitative/strategic/historical look at why Google and Yahoo and Facebook’s businesses may be different even when they compete for the same advertising dollars. What parts are yellow page/classified-like utility and what parts TV/radio-like media consumption? How will that influence steady-state margin?

That said, I might need a break. Please let me know whether you’re interested in this, have any other ideas, or you’d rather just see more robot cartoons…

[1] Roughly: “Beware bankers bearing DCFs.”